Are we on the cusp of a complete financial transformation, and if so, what does it mean for your wallet and your business? The evolution of payment systems is no longer a distant prediction; it's a rapid reality, reshaping how we conduct transactions worldwide.

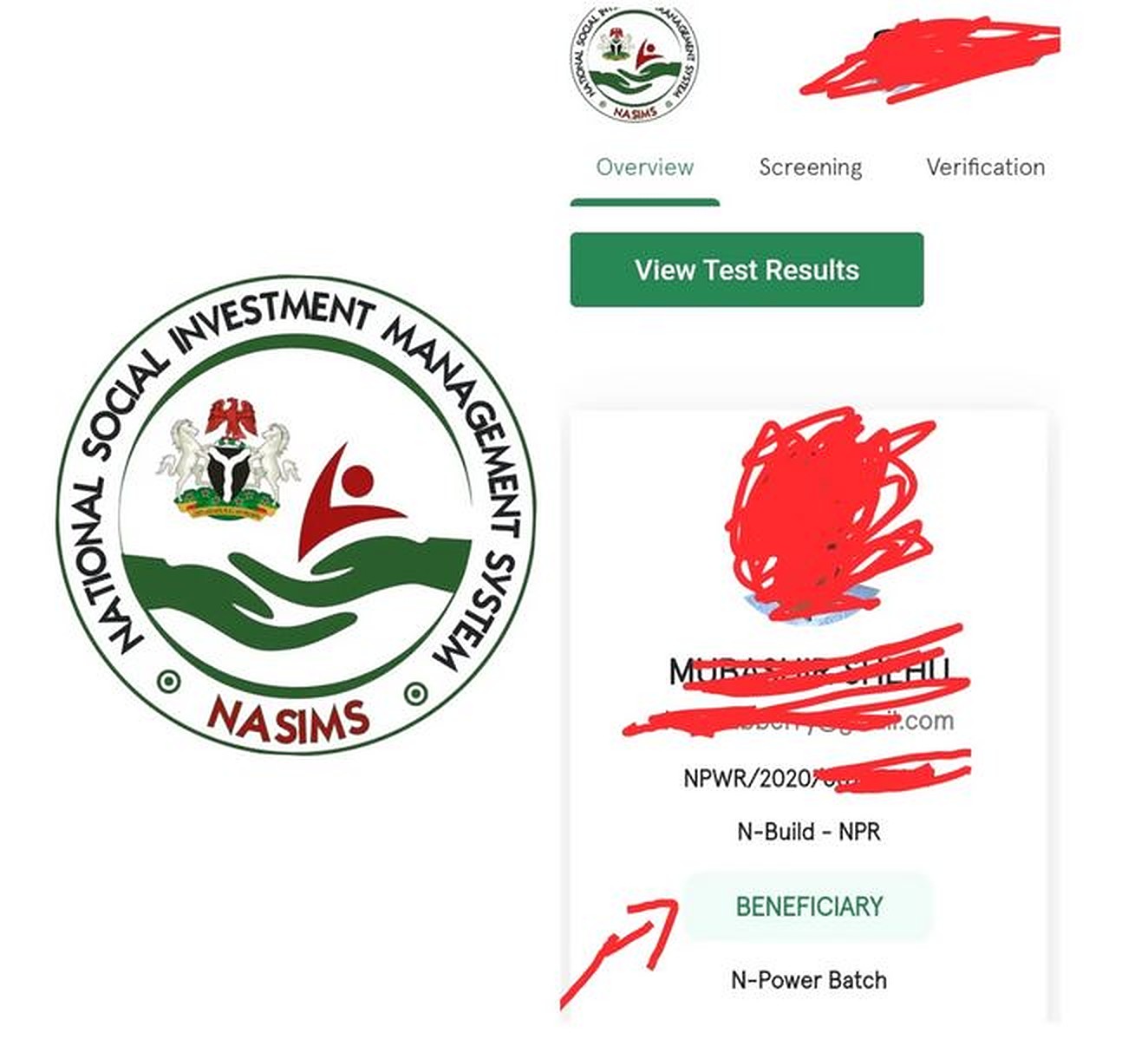

In this dynamic financial landscape, staying abreast of the newest developments is essential for both businesses and consumers alike. Nasims News on Payment Today aims to provide comprehensive updates and expert analysis on the pivotal issues shaping the world of payments. Whether you're a business owner, a fintech enthusiast, or simply someone curious about financial technology, this article offers crucial insights into the present state of payment systems and the future they hold.

As the global economy continues its shift towards digitalization, payment systems have become increasingly sophisticated, offering enhanced convenience, security, and efficiency. Nasims News on Payment Today is committed to covering all facets of payment systems, from traditional methods to the latest cutting-edge technologies such as blockchain and cryptocurrency.

- Vasozyte Reviews Is It Right For You Benefits Complaints Explored

- Kid Mom Cctv Heartwarming Moments Privacy In Public

This article offers a detailed overview of the latest trends, challenges, and opportunities within the payment industry. By the end of this analysis, you will have a better understanding of how these developments impact your financial decisions and business operations.

| Trend | Description | Impact |

| Mobile Payments | Use of smartphones for transactions. Apps like Apple Pay and Google Wallet lead the way. | Increased convenience and speed for consumers, new marketing opportunities for businesses. |

| Biometric Authentication | Utilizing fingerprint scanning and facial recognition for security. | Enhanced security, reduced fraud, and improved user experience. |

| Peer-to-Peer (P2P) Payments | Platforms like Venmo and PayPal allow instant money transfers. | Simplified money transfers between individuals, increased competition among payment providers. |

| Contactless Payments | Use of NFC technology for tap-to-pay transactions. | Faster checkout times, increased convenience, and evolving consumer habits. |

| Buy Now, Pay Later (BNPL) | Short-term financing options integrated into the payment process. | Increased sales for merchants, accessible credit for consumers. |

| Open Banking | Sharing financial data through APIs, improving financial management. | Increased transparency, and improved financial inclusion. |

- Movierulzcom Kannada 2024 What You Need To Know Alternatives

- Sone 385 English Sub Global Music Sensation Unveiled