Why is CNFiusd stock the talk of the town? Because it represents a compelling, albeit complex, intersection of global finance, technological innovation, and geopolitical maneuvering. This isn't just another stock; it's a microcosm of the modern investment landscape, rife with opportunities and fraught with challenges, making it a focal point for everyone from seasoned Wall Street veterans to curious newcomers.

The realm of stocks, as we all know, is rarely a simple equation. It's a dynamic arena where debates, risks, and potential rewards intertwine, shaping investor sentiment and market behavior. CNFiusd embodies this complexity, sparking discussions across financial forums, news publications, and the ever-present social media platforms. The dialogue surrounding this stock is polarized: some see a goldmine, others a potential pitfall. For those interested in investing or simply curious about the market's movements, understanding the core debates surrounding CNFiusd stock is paramount. This deep dive aims to dissect these key discussions, providing a comprehensive overview to aid informed decision-making.

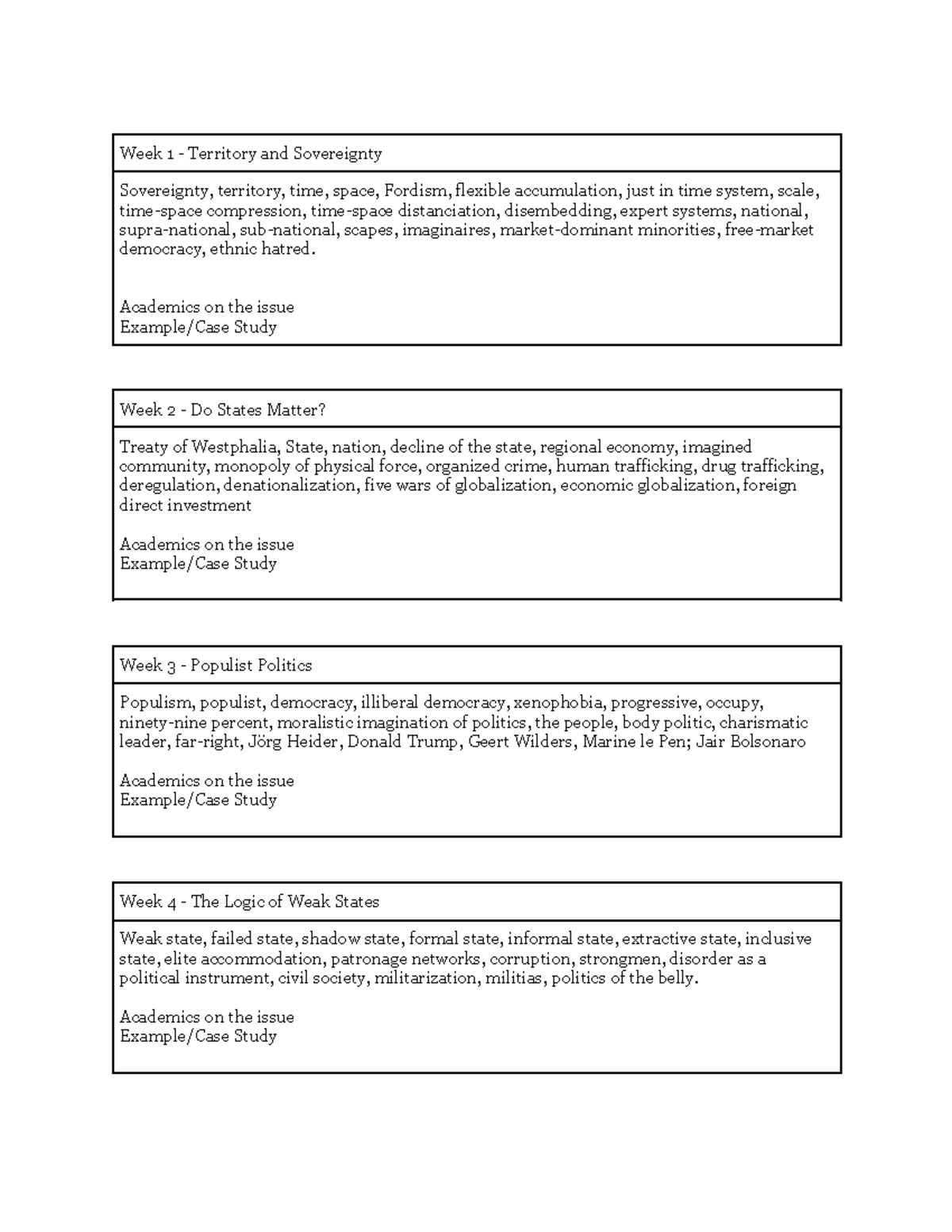

| Table: CNFiusd Stock - Key Data and Information | |

| Company Overview | Publicly traded company operating in technology, finance, and manufacturing. |

| Global Presence | Operates in multiple countries, including those with significant geopolitical risks. |

| Market Capitalization (Q3 2023) | $50 billion |

| Revenue Growth (YoY) | 12% |

| Profit Margins | 8% |

| Stock Price (as of Q3 2023) | $45 per share |

| Dividend Yield | 2.5% |

| Price-to-Earnings Ratio | 15x |

| Total Debt | $10 billion |

| Cash Reserves | $8 billion |

| Operating Cash Flow | $3 billion |

| ESG Initiatives | Focus on reducing carbon footprint and promoting workplace diversity. |

| Analyst Sentiment | Divided; some see it as a solid investment, others are cautious due to geopolitical risks. |

| Website Reference: | Example CNFiusd Stock Analysis (Replace with a real, credible source) |

One of the most significant factors influencing the CNFiusd stock debate is geopolitical tension. The company's operations span multiple countries, creating exposure to a complex web of political risks. Trade wars, sanctions, and diplomatic disputes can all impact CNFiusd's performance, directly affecting its bottom line and, consequently, its stock price. Some analysts suggest that these inherent risks render CNFiusd too volatile for sustained long-term investment. They argue that the unpredictable nature of international relations, coupled with the potential for rapid shifts in policy, introduces an unacceptable level of uncertainty. Conversely, other analysts emphasize CNFiusd's global presence as a competitive advantage. In this view, the company's diversified operations provide a buffer against localized economic downturns or political instability, allowing it to leverage opportunities in various markets.

- Sone 385 English Sub Global Music Sensation Unveiled

- Movierulz Proxy Risks Amp Legal Alternatives What You Need To Know

Consider the recent escalation of tensions between two major economies. CNFiusd's activities within these regions have experienced disruption, resulting in stock price fluctuations. While some investors perceive this as a warning sign, a signal to reduce holdings, others see it as an opportunity. The "buy low, sell high" strategy is a common approach among investors who believe that temporary setbacks can be exploited for profit. This situation is a classic demonstration of the risk-versus-reward dynamic that characterizes financial markets.

Within the broader conversation, technology's role deserves specific attention. CNFiusd's heavy investment in research and development is intended to maintain a competitive edge, often leading to innovative products and services. However, this emphasis on cutting-edge technology also raises concerns about data privacy and security. Critics question whether CNFiusd can effectively manage the potential downsides of its technological pursuits, including the risk of data breaches, regulatory scrutiny, and reputational damage. They suggest that a failure to adequately address these issues could undermine the company's long-term value and erode investor confidence.

Another major point of contention revolves around regulatory considerations. CNFiusd operates within heavily regulated sectors, placing it under constant scrutiny from various governmental bodies. The costs associated with compliance can significantly impact profitability. Additionally, any violations of regulations can result in substantial fines, legal challenges, and operational disruptions. Some investors view these factors as indicators of heightened risk, which makes them hesitant to invest. The companys reliance on complex technologies in these heavily regulated industries is another risk factor.

Conversely, proponents of CNFiusd highlight its track record of successfully navigating complex regulatory environments as a sign of strength. They argue that the company's ability to adapt to evolving regulations demonstrates resilience and provides investors with confidence in its long-term viability. They see the companys adaptability as a significant asset, underscoring its ability to withstand challenges and sustain operations. This perspective highlights the importance of strategic compliance and proactive risk management as essential components of business sustainability. It's a delicate balance, a constant process of evaluation, adaptation, and mitigation that requires careful consideration.

Market performance is another significant point of debate. Analysts have differing views, some pointing to consistent revenue growth as evidence of stability, while others focus on the stock's price volatility as a cause for concern. In reality, CNFiusds performance is influenced by global economic conditions, industry-specific trends, and the decisions made by its management. Understanding these influences is key to a comprehensive assessment of the stock.

To illustrate, consider the following key performance indicators:

- Stock Price: $45 per share (as of Q3 2023)

- Dividend Yield: 2.5%

- Price-to-Earnings Ratio: 15x

These metrics offer a snapshot of the company's current standing, but they must be analyzed within a broader context. For example, a high P/E ratio might suggest that investors have high expectations for future growth, while a low dividend yield could indicate that the company is reinvesting profits in expansion or research and development. A closer look is needed.

The financial health of CNFiusd is another critical aspect of the ongoing debate. The company's balance sheet reveals a strong cash position, but also a substantial amount of debt. This situation raises concerns about the ability to meet future financial obligations, especially in the face of economic uncertainties or industry-specific challenges. Those who express concern about the debt burden may argue that it could restrict the company's flexibility, limit its ability to invest in growth opportunities, or make it vulnerable to interest rate increases.

A closer examination of the financial data reveals the following:

- Total Debt: $10 billion

- Cash Reserves: $8 billion

- Operating Cash Flow: $3 billion

Proponents of CNFiusd often argue that strong revenue growth and ongoing cost-cutting measures can effectively mitigate the risks associated with high debt levels. They may point to a healthy operating cash flow as evidence that the company has the capacity to meet its obligations and generate profits. These figures present a more nuanced picture of CNFiusds financial status. The debate centers on whether its debt levels are sustainable, and the balance between risk and opportunity.

Environmental, Social, and Governance (ESG) factors have become increasingly vital in the investment world, and CNFiusd is no exception. The company has implemented strategies to minimize its carbon footprint and promote diversity in the workplace. Nevertheless, critics contend that additional measures are required to address environmental concerns and improve governance practices. These criticisms often focus on the scope and effectiveness of sustainability initiatives, as well as the transparency and accountability of corporate governance. Investors who prioritize ESG factors should scrutinize CNFiusds efforts in these areas, carefully assessing its sustainability practices, corporate governance policies, and ethical standards. The debate concerning ESG is expected to intensify as it plays a greater role in the financial world.

Investor sentiment is a critical component in the debates surrounding CNFiusd. The experts are divided on whether the stock is overvalued or undervalued, and this difference in opinion reflects the complexity of the situation. Some analysts believe that CNFiusd's potential for growth justifies its current valuation, pointing to its innovation and market position as key drivers. Others believe that the current price is too high, arguing that the stock is trading at a premium that doesn't fully align with its fundamentals.

Here's what some of the top analysts are saying:

- Analyst A: "CNFiusd is a solid investment for those who can tolerate risk."

- Analyst B: "Im cautious about CNFiusd due to its exposure to geopolitical risks."

- Analyst C: "The companys focus on innovation gives it an edge in a competitive market."

These varying viewpoints highlight the lack of universal consensus. The interpretation of data, the evaluation of risks and rewards, and the assessment of future prospects all play a role in shaping this sentiment. It's a complex interplay, where each analyst brings their own perspective and biases to the equation.

Analyzing CNFiusd's past performance offers useful insights into the current debates. The company has endured multiple economic downturns and industry-specific disturbances. Its ability to adapt and overcome these past difficulties may reassure investors, suggesting a capacity to face present challenges. However, history teaches us that no business is immune to failure. The companys historical context helps in evaluating its capacity to withstand changing circumstances.

As you evaluate CNFiusd, examine how the company has responded to challenges throughout its history. This can help you understand its current ability to adapt. You can also gather information by considering factors such as the companys management decisions, the markets responsiveness to its actions, and the overall economic landscape. These factors can provide insight into the company's capacity to overcome current challenges.

The future of CNFiusd stock is uncertain, which is a fundamental aspect of investment. The company has the potential to flourish in a quickly evolving world, but it also encounters significant risks. It's essential to weigh the pros and cons prior to making a decision. A complete analysis will require considering a wide array of factors.

Consider these crucial factors in the coming years:

- Global economic trends

- Technological advancements

- Regulatory changes

- ESG initiatives