Is China Online Education Group stock a high-stakes gamble or a golden opportunity? The online education market in China, once a darling of global investors, now presents a complex picture, with the stock of China Online Education Group at the heart of a heated debate.

From the bustling metropolises of Shanghai to the quiet villages of Sichuan, the demand for education in China has always been intense. Today, that demand has found a new frontier: the internet. Online education in China has exploded in popularity, driven by the convergence of rising disposable incomes, a growing middle class eager to secure their children's futures, and increasing access to the internet. But this rapid growth hasnt been without its challenges. The market is dynamic, the regulatory environment is shifting, and the competitive landscape is cutthroat. This article dives deep into the key debates, trends, and controversies surrounding China Online Education Group stock, providing a comprehensive analysis for investors seeking to navigate this intricate terrain.

| Category | Details |

|---|---|

| Company Name | China Online Education Group (formerly known as 51Talk) |

| Industry | Online Education |

| Key Services | K-12 tutoring, professional development courses, English language training (primarily focused on one-on-one and small group lessons) |

| Location | Beijing, China |

| Ticker Symbol (NASDAQ) | COE (Now delisted) |

| Current Status | Delisted from NASDAQ, reflecting significant regulatory challenges and market shifts within the online education sector in China. The delisting occurred after significant changes in the regulatory landscape and business model. |

| Website (Historical) | https://ir.51talk.com/investor-relations |

Let's delve into the specifics. China Online Education Group, often referred to as 51Talk, has been a prominent player in China's burgeoning online education sector. The company, offering a wide range of educational services, from K-12 tutoring to professional development courses, built its business on the promise of accessible and affordable education, particularly for English language learning. Its stock, however, has experienced a turbulent journey, reflecting the volatile nature of the industry and the impact of both internal and external forces.

- Sone 385 English Sub Global Music Sensation Unveiled

- Kannada Movierulz Com 2025 A Deep Dive What You Need To Know

A central debate surrounds the sustainability of the company's business model. Critics point to intense competition and the increasing regulatory scrutiny as potential roadblocks to growth. Supporters, on the other hand, often highlight the company's innovative approach to online learning and its established brand presence, arguing that these factors will allow it to navigate the challenges. The reality, as with any investment, is nuanced. The online education market, as a whole, and 51Talk specifically, have experienced significant shifts, prompting investors to assess risk and potential reward carefully.

Key Drivers of Growth in the Online Education Market

Several key factors have fueled the explosive growth of China's online education market. These drivers not only shaped the rise of companies like China Online Education Group but also continue to influence the industry's trajectory.

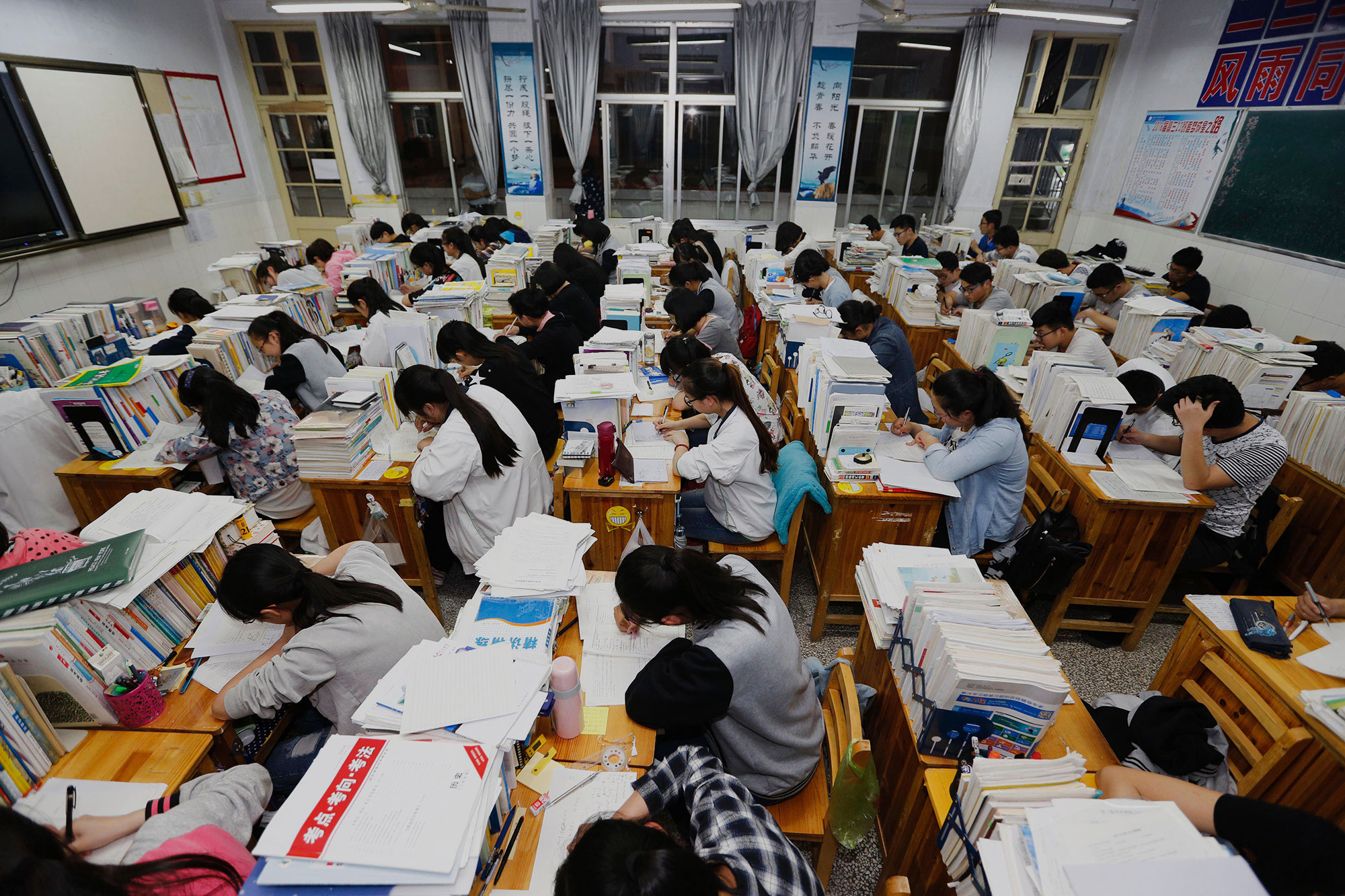

- Increasing Demand for Quality Education: Chinese parents, particularly those in urban centers and the rapidly expanding middle class, place a high premium on education. This translates to a willingness to invest heavily in their childrens future, creating a robust market for educational services. Online platforms offer a convenient and, in some cases, more cost-effective solution compared to traditional brick-and-mortar schools and tutoring centers. The emphasis on achieving high scores in standardized tests, such as the gaokao (the national college entrance exam), further intensifies the demand for supplementary education.

- Increased Internet Penetration: The widespread adoption of smartphones and the expansion of high-speed internet access across China have been crucial. As more people gain access to the internet, the potential reach of online education platforms has expanded significantly, particularly in less developed regions. This improved accessibility has allowed companies to tap into a larger pool of potential students, regardless of their geographical location.

- Government Support: While recent regulations have introduced challenges, the Chinese government has historically supported the growth of digital learning as part of its broader education reform agenda. Initiatives aimed at improving educational outcomes and promoting technological integration in schools have indirectly benefited online education providers. This support, however, has evolved, with a greater emphasis on regulating the sector to ensure quality and protect consumers.

- Technological Advancements: Innovations in AI, big data, and cloud computing have played a significant role in enhancing the learning experience. AI-powered platforms offer personalized learning paths, adapting to the individual needs and pace of each student. Big data analytics helps in tracking student progress and identifying areas where they may need additional support. Cloud computing provides the infrastructure needed to deliver online courses at scale. These advancements have made online education more interactive, engaging, and effective.

Despite these favorable trends, the market is fiercely competitive. Numerous companies are vying for market share, leading to aggressive marketing campaigns, price wars, and a constant need for innovation. This competitive environment presents a significant challenge for all players, including China Online Education Group.

- Kannada Movie Rulzin Your Guide To Sandalwood Streaming

- Crystal Lusts Death Cause Legacy What Happened

The Regulatory Landscape

Perhaps the most significant factor impacting China Online Education Group stock is the evolving regulatory landscape. The Chinese government has introduced a series of measures aimed at regulating the education sector, particularly those operating online. While these regulations are intended to protect consumers, ensure the quality of education, and address broader social concerns, they have created significant uncertainty for investors and have, at times, severely impacted the financial performance of companies in the sector.

One major area of concern involves restrictions on advertising and marketing practices. The government has imposed strict limits on the types of advertisements that can be used, the content they can include, and the channels through which they can be distributed. These restrictions have made it more difficult for companies to attract new students, which can directly affect revenue growth. Further, the regulations place limitations on the involvement of foreign teachers and the curriculum that can be taught. These strictures are often implemented to ensure that educational materials align with the government's values and that the quality of teaching meets specific standards.

Beyond advertising, the government has also introduced requirements concerning the qualifications of teachers, the pricing of courses, and the overall structure of the online education business model. These regulations add complexity and cost to operations, potentially impacting profitability. For example, the requirement for companies to obtain specific licenses to operate has created barriers to entry and has led to increased compliance costs. The regulations on tuition fees are another factor, limiting the ability of companies to raise prices and potentially affecting revenue.

How Are Investors Reacting to Regulatory Changes?

The regulatory changes have elicited a mixed response from investors. The stock price of China Online Education Group, and of many of its competitors, has been volatile, reflecting the uncertainty and the ongoing assessment of the impact of these new rules. The following points provide further clarity:

- Short-Term Pain, Long-Term Gain: Many investors acknowledge that the regulatory changes may cause short-term challenges, but they believe these actions will, in the long run, benefit the industry. They view the regulations as a step towards creating a more level playing field by weeding out less reputable players and ensuring that all companies adhere to higher standards. They anticipate that more stable and regulated environment can contribute to sustainability.

- Adapt or Die: Companies that are unable or unwilling to adapt to the new regulatory environment are likely to face significant challenges, including closure. Companies that can innovate and comply with the new regulations have a chance to thrive. This means that the companies must be prepared to adjust their business models, improve the quality of their offerings, and enhance their compliance efforts. Those that can navigate the changes effectively have a strategic advantage.

- Market Sentiment: The stock market often overreacts to regulatory news. This leads to sharp price fluctuations. The initial reaction to new regulations is often negative, resulting in a sell-off of stocks. However, as the market gains a better understanding of the impact of the regulations and as companies begin to adapt, investor sentiment can shift. The price volatility often presents opportunities for astute investors who have a long-term perspective and can assess the underlying value of the company.

In this context, the challenges for China Online Education Group are significant. It must adapt to the new regulations, enhance the quality of its offerings, and manage its finances effectively. The company's ability to navigate these challenges will be critical to its long-term success.

Financial Performance

In the world of investing, financial performance is paramount. A close examination of China Online Education Group's financial results is therefore essential to assess its strengths, weaknesses, and potential for future growth. As in all investment decisions, investors should study a range of factors, with the goal of formulating reasonable expectations.

Historically, the company, like others in the online education sector, exhibited impressive revenue growth. The demand for online learning services in China was robust, and 51Talk saw its user base and revenue streams expand rapidly. However, the path to profitability has been more challenging. Intense competition and rising operational costs have squeezed operating margins, creating concern about the company's ability to translate its revenue growth into sustainable profits.

Key Financial Metrics to Watch

A number of key financial metrics are crucial for any investor to monitor. These indicators provide valuable insights into the financial health and future prospects of China Online Education Group (and indeed, of any company):

- Revenue Growth: It is vital to examine whether a company is continuing to increase its user base and expand its revenue streams. Rapid revenue growth is a positive sign, but it must be sustainable. Investors should look for consistent growth over time. A decline in revenue growth or a deceleration suggests the company may be facing challenges in attracting and retaining customers. Investors should be aware of the impact of competition, regulatory changes, and the overall economic climate in the assessment of revenue growth.

- Operating Margins: These metrics demonstrate how efficiently the company is managing its costs. Improving profitability by cutting costs and optimizing operations is a key goal. Narrowing operating margins may indicate that the company is struggling to control its expenses, particularly in a competitive market. Investors should analyze operating margins to determine the long-term viability of the business model. The company's profitability depends on its ability to manage costs effectively and maintain a healthy margin.

- Cash Flow: It is crucial to determine whether a company has sufficient cash on hand to sustain its operations and continue its investments in future growth. Strong cash flow is a positive sign. Investors should be very concerned if the company is consistently burning through cash. The capacity to generate and manage cash flow is vital for the long-term survival and development of any company. Investors must study the cash flow statement to determine the company's financial flexibility.

The ability of China Online Education Group to generate sustainable profits, maintain healthy operating margins, and manage its cash flow effectively will be critical in determining the long-term viability of its stock. Investors need to weigh the risks and rewards associated with the companys financial performance carefully before making investment decisions.

Competition in the Online Education Space

China's online education market is characterized by intense competition, with numerous players vying for market share. The competitive landscape is dynamic and ever-evolving, requiring companies to constantly innovate and adapt. The key competitors include several well-established companies, each with its own strengths and weaknesses. These companies include New Oriental Education & Technology Group, TAL Education Group, and VIPKid.

New Oriental Education & Technology Group is one of the largest and most well-known education providers in China. With a long history and a broad range of offerings, including language training, test preparation, and K-12 tutoring, it has a strong brand presence and extensive reach. However, it faces the same challenges as other companies in the market, including regulatory pressures and the need to adapt to changing consumer preferences.

TAL Education Group (also known as Xueersi) is another major player. It focuses primarily on K-12 tutoring and test preparation. TAL is known for its focus on technology and innovative teaching methods. It has also faced the challenges of regulatory changes and increased competition.

VIPKid (though it is no longer operating in the same form due to regulatory changes) was a significant player in the online English language learning market, connecting Chinese students with native English-speaking teachers. VIPKids focus on one-on-one and small group classes made it popular among parents, but its business model was severely impacted by government regulations.

China Online Education Group (51Talk) has carved out a niche for itself by focusing on online English language learning, primarily through one-on-one and small-group classes. The company has built its business on providing accessible and affordable education, often targeting students in smaller cities and rural areas. However, the company faces competition from larger, well-established players with deeper pockets and broader reach, making the competitive landscape particularly challenging.

What Sets China Online Education Group Apart?

Several factors differentiate China Online Education Group from its competitors, though many of these have become less prominent due to the changing market conditions:

- Technology-Driven Solutions: The company invested in AI and big data to create personalized learning experiences for students. This included AI-powered lesson plans, progress tracking, and adaptive learning algorithms designed to improve the efficiency and effectiveness of online learning.

- Strong Brand Presence: The company has built a reputation for innovation and quality, helping it to attract and retain a loyal customer base. This has been particularly true in areas where online learning was becoming more accessible to families.

- Focus on User Experience: The company prioritized user satisfaction, ensuring that its platforms were easy to use, engaging, and offered a positive learning experience. This has involved continuous improvement of its online platforms.

While these factors have given the company a competitive edge, they also present challenges. They involve high R&D costs, the need for constant innovation, and the requirement to adapt quickly to changes in technology and the market. Despite these qualities, the company has had to undergo a transformation to adapt to the shifting market conditions, including regulatory changes.

Market Trends and Future Outlook

The online education market in China is expected to continue to grow in the future, despite the challenges and regulatory changes. Increasing demand, technological advancements, and the ongoing evolution of learning preferences are driving this trend. However, the landscape is likely to become even more competitive, with both new entrants and established players vying for market share. The company's capacity to adapt and innovate will be crucial in determining its future success.

The company's ability to adapt to changing market conditions and regulatory requirements will be crucial in determining its success.

Predictions for the Future

Several trends are likely to shape the future of China Online Education Group and its stock performance:

- Increased Focus on AI: The company may double down on its investments in AI and machine learning to enhance the learning experience, potentially offering more personalized learning paths, automated feedback, and adaptive assessments.

- Expansion into New Markets: The company may seek to expand into international markets.

- Sustainability as a Priority: China Online Education Group, like other companies, may adopt more sustainable practices to appeal to environmentally conscious consumers.

These trends could shape the future of the company and its stock performance. Investors should keep a close eye on these developments to make informed decisions.

Investor Sentiment

Investor sentiment plays a crucial role in determining stock prices. What people are saying about the stock of China Online Education Group offers valuable context for assessing the company's prospects. The sentiment can range widely, from bullish enthusiasm to bearish caution.

On social media platforms like Reddit and Twitter, investors are divided on the companys prospects. Some are bullish, pointing to the company's strong brand presence and innovative approach. Others are bearish, citing concerns about regulatory risks and financial performance. Investor sentiment can change quickly in response to news, market trends, and economic developments.

Key Points from Investor Discussions

Recent investor discussions reveal key points for consideration:

- Regulatory Risks: Many investors express concern about the impact of government regulations on the companys business model and profitability. They worry that regulations could limit the company's ability to grow, attract new customers, and maintain its existing market share.

- Financial Performance: There are mixed opinions about the companys ability to deliver sustainable profits. Some investors believe that the company's revenue growth is promising, while others are concerned about its operating margins, cash flow, and overall financial stability.

- Long-Term Potential: Despite the challenges, many investors believe that the company has strong long-term potential if it can successfully navigate the current uncertainties, adapt to regulatory changes, and achieve sustainable profitability.

These discussions highlight the complexity of investing in China Online Education Group stock. It's important to consider multiple perspectives before making a decision.

- Kannada Movies Safe Legal Ways To Download 2025 Avoid Rulez2

- Movierulz 2024 Guide To Downloading Movies Safety Alternatives